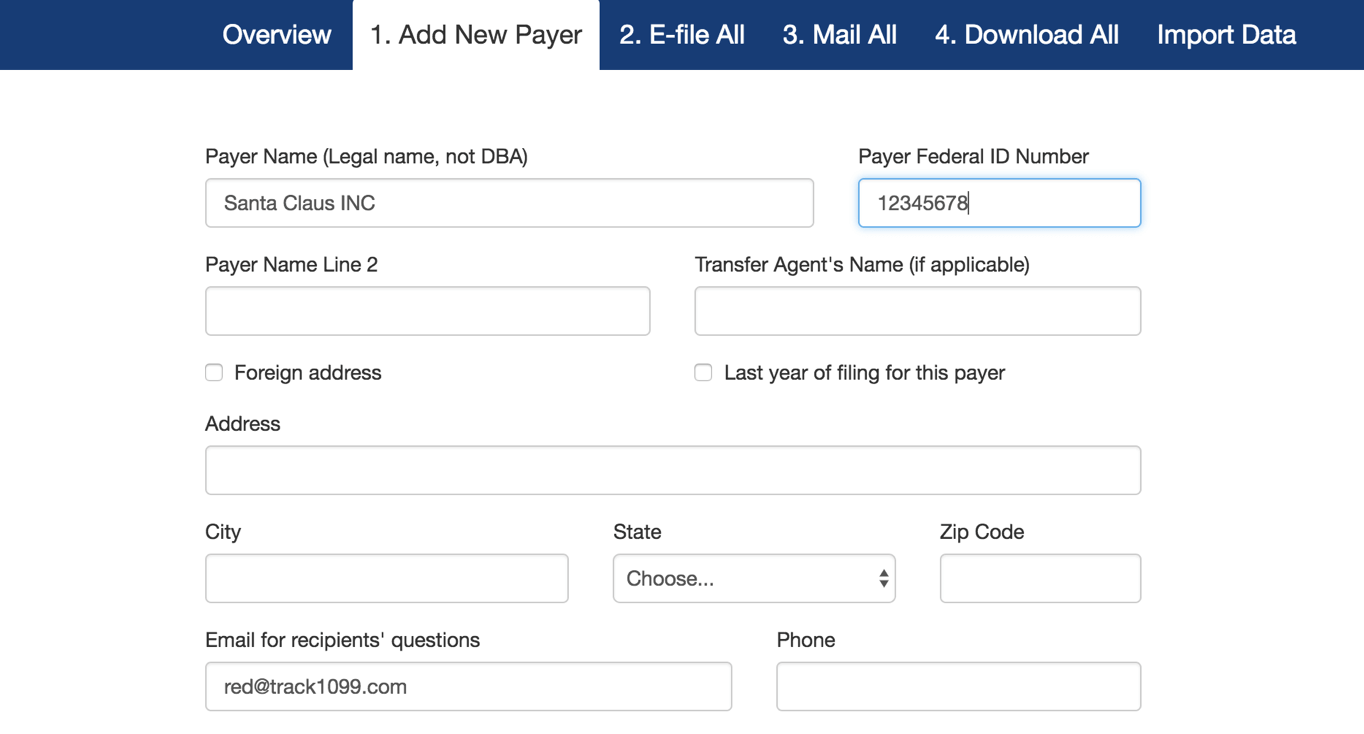

Step 1:

Add Your Payer

Explore Track1099 for free.

We don't charge until you schedule e-file.

Watch our Easy 1099 video

Step 2:

Enter Your Recipients

Use our easy manual entry or CSV upload options.

Transfer from QB, QBO, Xero, Bill.com.

Transfer from last year or our W-9 service.

Watch our importing videos

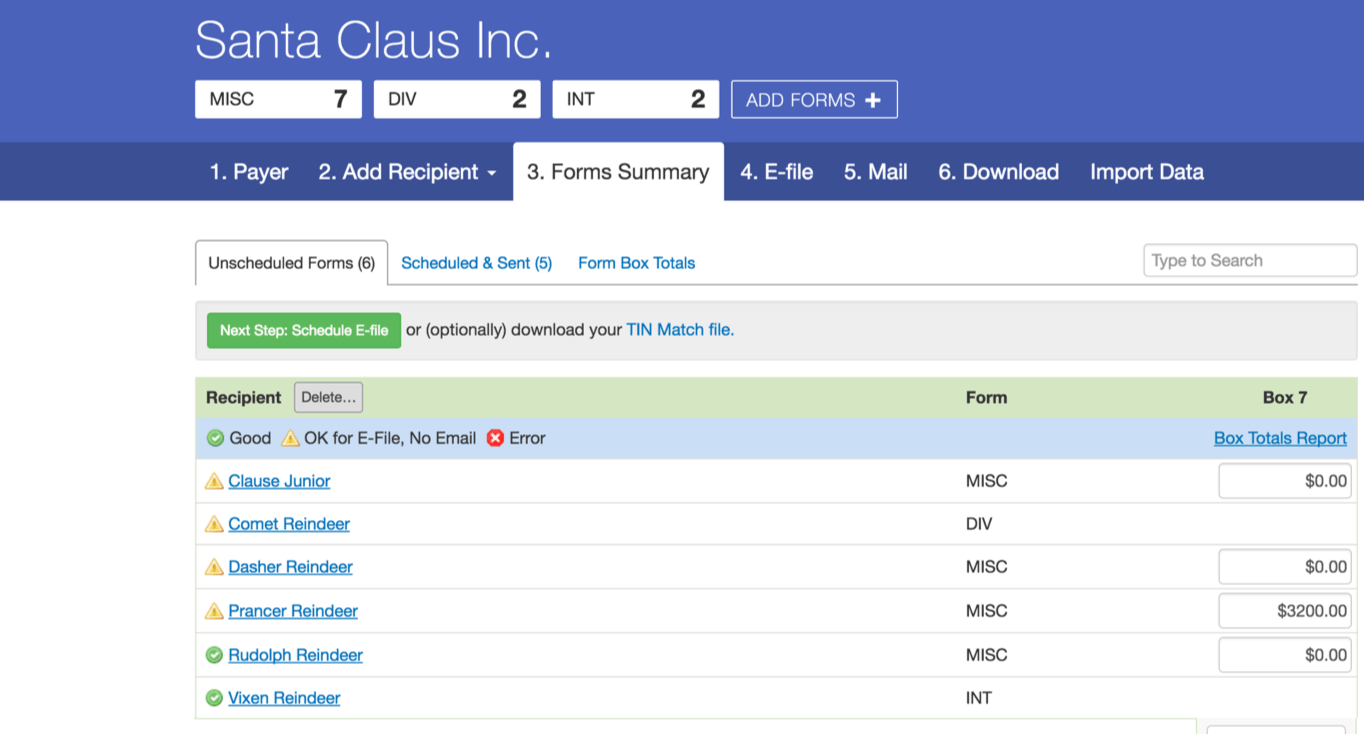

Step 3:

Review Your Forms

Green means good for IRS e-file and recipient e-delivery.

Yellow is good to IRS e-file and postal mail.

Errors show up in red.

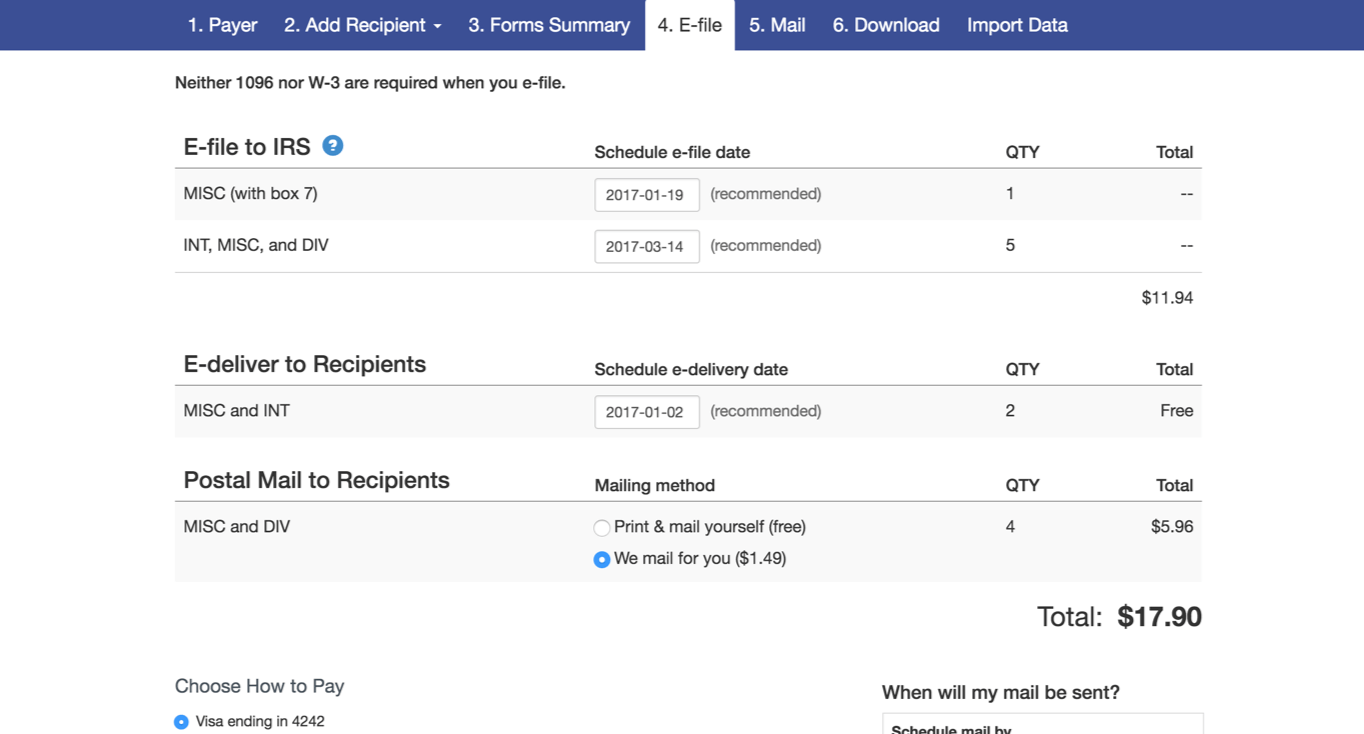

Step 4:

Schedule E-file & E-delivery

Neither W-3 nor 1096 is required.

We prompt you for the correct IRS due date.

Pay with any major credit card.

Watch our e-delivery or postal mail video

Step 5:

Download For Your Records

Free PDF and CSV files

Free state files, as needed

Free recipient e-corrections

Step 6:

Add More Payers

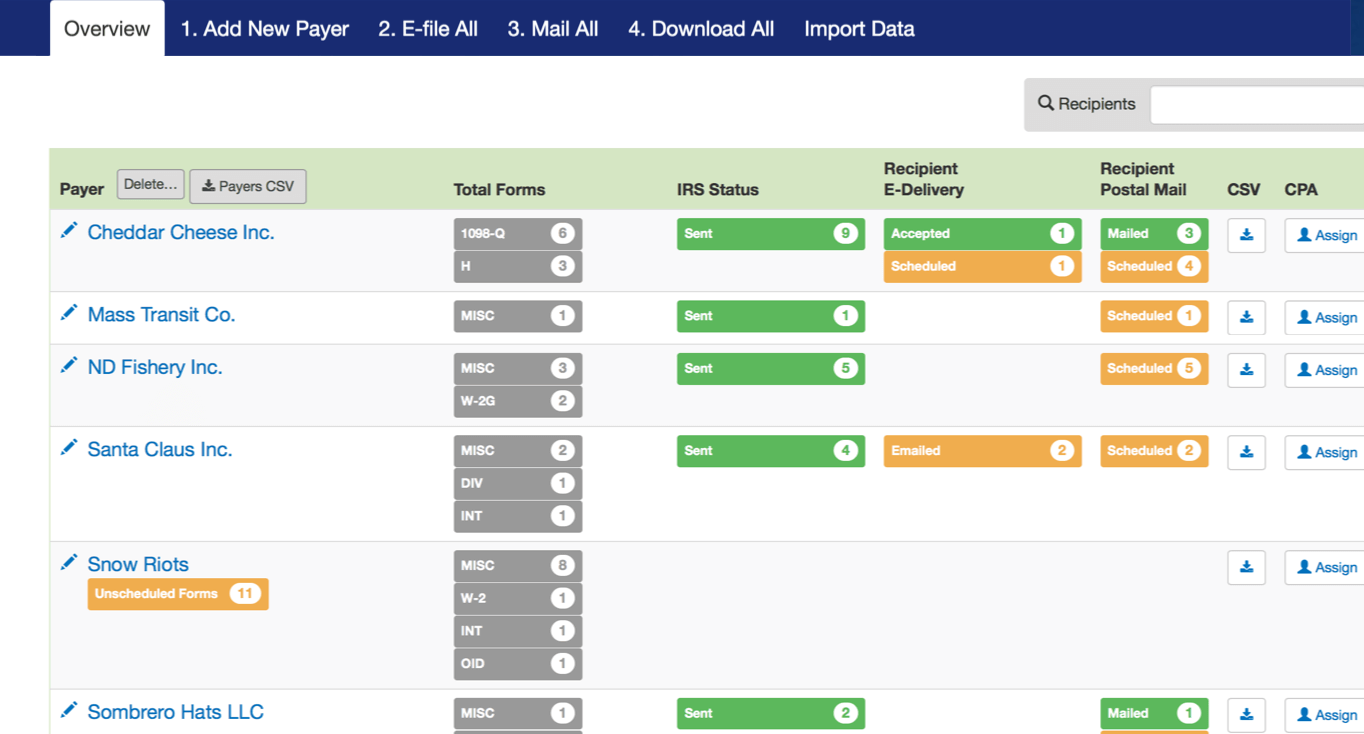

Our All Payers dash gives you a one-glance overview.

Manage your team members easily.

Statuses go from Scheduled -> Sent -> Accepted

You're Done!

Next year, your information is easily transferred.

We keep your data available for five years.

Get started for free